Things That Social Security Can’t Tell You

By Gary Duell |

This post is not a myth. It’s a more thorough response to a question asked at the end of my two-hour Social Security classes: “What are the things Social Security can’t tell me?” My broad response was that they can’t tell you what you should do, only the effects of your timing. There are a lot of […]

IRS Releases Important Inflation-Adjusted Numbers Today

By Gary Duell |

As expected, here are the most significant of the more than 60 “indexed” rules in the IRS code. Most notable is the increase in income ranges for all the tax brackets. Most disappointing unchanged numbers: The Internal Revenue Service today announced the annual inflation adjustments for more than 60 tax provisions for tax year 2024, including the […]

MYTH: THE ISRAELI HAMAS CONFLICT IS SOLVABLE

By Gary Duell |

I wish this were not a myth and am unsure whether it is or is not. I’m not optimistic because this has been going on my entire life. And I’m no kid. As a financial planner, why am I commenting at all about the situation? Because our firm works extremely hard to appropriately intervene in […]

MYTH: Wage Increases Cause Inflation

By Gary Duell |

Today’s post is from one of my favorite columnists, Peter Coy. The upshot of the evidence he gathers is that, at worst, wage increases are a lagging indicator of inflation, they happen after an inflationary period. There’s little evidence that wage increases cause inflation. – Gary There’s not much evidence to support the wage-price spiral […]

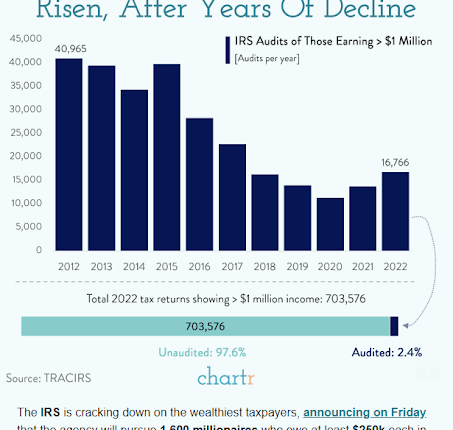

MYTH: Our Tax Systems Are Fair

By Gary Duell |

I still feel the need to preface every blog post with the reminder that these blog topic headings are myths, unless I indicate otherwise. It is certainly a myth that our tax systems are fair. Here’s another look at relative audit rates. The wealthy have enjoyed the greatest decline in audit rates. And this is […]

Ready To Start?

Get one step ahead of the wealth preservation game by getting in touch with us today for more information, and to get started.