Services

Getting Your Financial House in Order

Not losing your money is my #1 priority. But how can you avoid losses without having to settle for lousy rates of return that won’t keep up with inflation? How can you keep from running out of money? The answer is risk pooling. Social Security is a great example of risk pooling. People who die early make it possible for those who live longer to keep getting paychecks. There are many excellent tools for pooling risk.

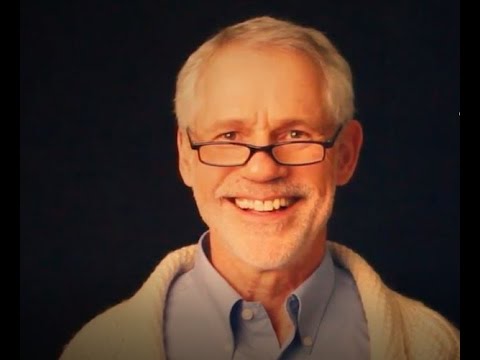

Request your FREE 30 minute consultation with

Gary

Today!

Asset Allocation

Where should your money be right now? Is it enough just to have a pie chart? What about rebalancing? Are target date funds the answer? Which investments/assets are most appropriate for which purposes?

Cash Flow Plans

It’s all about cash flow. Studies have shown that the people who are happiest in retirement are not those with lots of assets. It is folks who know their income will meet or exceed their budget and will continue to do so as inflation creeps in. This is the most challenging, and rewarding, task for me.

Estate Planning

What is your estate? Everything you own. And estate planning involves more than just what happens to your stuff after you die. It also eases difficulties that arise should you be disabled or incapacitated. Risk pooling can be a huge benefit here.

Long Term Care is the most prominent, largely unfunded healthcare risk.

Because of this, long term care insurance has become very expensive. However, although insurance is an ideal tool to pool this risk, it may not be affordable or even necessary. There are other clever ways to squeeze protection out of your existing assets, from hybrid annuities to HECMs, from Medicaid planning to moving to India. Seriously!

Retirement Planning

This topic requires all the above puzzle pieces. A holistic, frank look at where you are now is the first step to figuring out where you need to go and how to get there. A map is worthless unless you know your location!

Tax Optimization

And I mean reducing your taxes, not maximizing them. Yes, even the average taxpayer has quite a few tools for reducing taxes from taking advantage of all the loopholes and credits to careful timing of income and expenses, especially in one’s 60’s.

Ready To Start?

Get one step ahead of the wealth preservation game by getting in touch with us today for more information, and to get started.