The truth of this blog heading depends, of course, on the health and wealth of the individual. But it is still rarely true. In the plans I’ve developed, Taxes usually exceed projected health care costs 3 to 1. I think a lot of health care cost calculators are unjustifiably alarmist for the purpose of selling insurance. For example, AARP’s calculator said my health care costs would be close to $800,000 during my lifetime.

Huh? If I met my maximum out of pocket every year for the rest of my life that would only be about $120,000. Oh, you know, I’ll bet they’re referring to the total healthcare cost before insurance. So why didn’t they just say that?

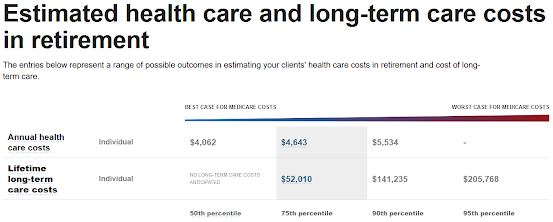

Vanguard HealthCare Cost Estimator, on the other hand, seems to be more accurate. I plugged in all my details and here’s what it churned out:

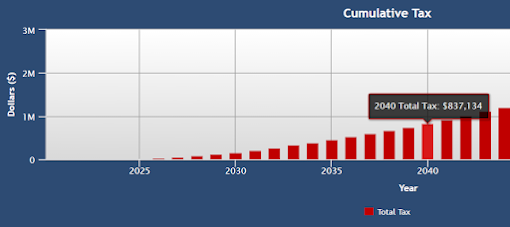

So that’s a bit less than $120,000 in today’s dollars. Below is a typical cumulative income tax projection that I create for clients. (Here in Portland, OR we should probably include property taxes too as they average $500/mo. and increase about 3%/yr. This is especially draining for fixed income folks. But that’s not included in the chart below). Total tax bill by 2040 is $528,000!!

Do you think it’s essential, then, to have a retirement cash flow plan that factors in taxes?

Gary