Before I get started, two caveats are in order:

- Remember that these blog titles are Myths.

- By “conservative” I mean in terms of your financial security. Politically I range from a Teapartier to a bleeding heart Liberal, depending on the issue.

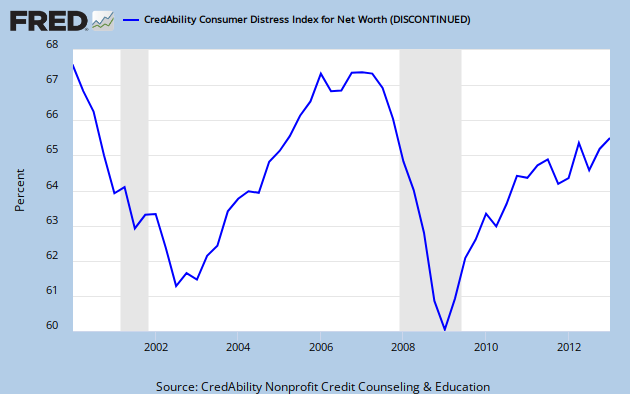

First, take a look at this fascinating graph (I know. That may be an oxymoron):

(If you can’t read the small print, or if you would like to tweak the parameters yourself, click on the link directly below the graph.) I love graphs because they make the invisible visible, the complicated simple, the hazy, clear. Beginning in the year 2000 this graph measures 50 different data points which reflect consumer confidence. The lower the score, the lower the level of “Consumer Distress”. The key take away: note the peak in consumer confidence (i.e., lack of distress) just before each market crash. Yet mildly rising consumer confidence is touted in the press as reason for optimism. Which of course is circular thinking, “We should be optimistic because we are optimistic”. Sounds stupid when I put it that way doesn’t it?

But here are the facts which should sober up your drunken revelry about the “record” stock market indices. First of all, Americans lost $16 trillion in household wealth in the Bush recession. It appears we’ve just about gotten it back. But secondly, unless you factor in inflation & the increase in the number of households, you’re dreaming. The average family is only about halfway recovered and would need to double current asset values in order to be “even”. Ain’t gonna happen. Not because of consumer confidence.

My point here is not to put my elbow in the party cake. My point is to emphasize the importance of not losing money. Risk management is not only more important than chasing the Wall Street casino but it is also the only factor that is in your control. This is both conservative and optimistic: if you can reduce risk and have sufficient retirement income, why gamble with your future?? Why gamble at all?