This is a myth based on falsehoods circulated by, of course, large powerful companies who are not ESG in their practices. To appreciate how false this myth really is it is important to have a basic understanding of what the term means. The following summary was written by ChatGPT using the query “basics of ESG investing:

ESG investing, also known as sustainable or socially responsible investing, is an investment approach that considers environmental, social, and governance factors alongside traditional financial analysis. Here are some basics of ESG investing:

- Environmental factors: ESG investing considers a company’s impact on the environment, including its energy and resource usage, waste and pollution management, and carbon emissions. This information is used to assess a company’s sustainability and its ability to address the risks and opportunities related to climate change.

- Social factors: ESG investing also looks at a company’s impact on society, including its treatment of employees, customers, suppliers, and the communities in which it operates. This information is used to assess a company’s social responsibility, diversity and inclusion, and the potential social and reputational risks.

- Governance factors: ESG investing considers a company’s corporate governance structure, including its leadership, board composition, and executive pay. This information is used to assess a company’s transparency, accountability, and ethical business practices.

- ESG investment strategies: There are different ESG investment strategies, such as positive screening (investing in companies with strong ESG performance), negative screening (avoiding companies with poor ESG performance), and thematic investing (investing in companies that are aligned with specific environmental or social themes).

- Performance: ESG investing aims to achieve both financial and non-financial outcomes. Studies have shown that companies with strong ESG performance may have better financial performance and lower risk over the long term. However, there is no guarantee that ESG investing will always outperform traditional investing.

- ESG data and metrics: ESG investing relies on data and metrics to assess a company’s ESG performance. There are different ESG data providers, and each may have their own methodology and ratings. It’s important to understand the limitations and biases of ESG data and to use multiple sources of information when making investment decisions.

Not a bad summary in ten seconds! The rest of this is written by ChatGD [Gary Duell]. And it took me longer than 10 seconds!

This myth, that ESG investing is “feel-good social engineering”, is almost amusing in how ridiculous it is if you stop to think about it for a bit. First of all, what’s wrong with feeling good? Who doesn’t want to feel good? More importantly, what’s wrong with feeling good for mentally healthy reasons? Is it nuts to feel bad when the way you invest is causing harm? No. It’s entirely appropriate. To the contrary, it is nuts to feel good, or simply not care, when your money is causing harm. ESG investing is portrayed as naïve. But what is genuinely naïve is to ignore all the costs- to yourself and others -associated with how you invest and spend your money. More importantly, what if ESG investing produced better investment results over the long term? If you do a search you’ll find recurring evidence that:

It has been empirically validated that companies with higher ESG scores tend to do better than companies with lower ESG scores in terms of stock performance and underlying financial metrics.

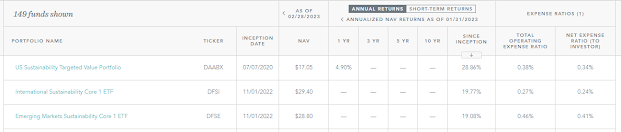

In fact, here is a search of Dimensional Funds’ 149 ETFs ranked by annual returns. Note that the top three are all Sustainability focused.

I found one article in the trade press (Which I can no longer find. They probably took it down.) that made a big deal about how ESG funds had inferior performance vs non-ESG screens. Finally, at the end, an actual number: 0.8% lower returns. And that was just on negative ESG screens (avoiding bad companies). Positive ESG screens deliver better performance despite ESG funds being more expensive due to the extra work involved.

So don’t fall for this myth. You can do good while doing well.

Best Always,

Gary Duell