Yes, Suze Orman is a myth, writ large. And much of what Suze Orman says on Oprah.com is mythological. I was especially taken aback by this interview done on Oprah.com. As far as I know, she hasn’t changed her tune. I almost hate to respond to it and thereby increase its exposure. But I feel a professional and ethical obligation because this is dangerously harmful advice.

Q: My financial adviser suggested that I invest in index annuities. Are they safe?

Suze: I’m not a fan of index annuities. These financial instruments, which are sold by insurance companies, are typically held for a set number of years and pay out based on the performance of an index like the S&P 500. (Be advised that insurers aren’t necessarily transparent about how they calculate any gains credited to your annuity.) They do offer a guaranteed return, but it can be under the rate of inflation, and there are caps on the amount of interest you can earn. Plus, if you don’t want to keep an annuity for its entire term, you could lose 10 percent or more of your investment to a surrender charge. Honestly, I’d be suspicious of any adviser who wants you to go this route. Instead, I’d recommend that you stick to your workplace retirement plan, if you have that option. You can contribute up to $17,500 this year ($23,000 if you are at least 50). If you don’t have a company 401(k) or you have more funds to invest, you can set aside $5,500 ($6,500 if you are at least 50) in a traditional or Roth IRA.

I’m “not a fan of” any celebrity whose celebrity is more important to them than the innocent folks to whom they carelessly dispense flawed and incomplete advice. “Honestly, I’d be suspicious” of anyone who isn’t a fan of indexed annuities, especially these days. Why do innocent consumers gravitate toward these financial entertainers? This may be a clue:

https://getpocket.com/explore/item/why-do-people-mistake-narcissism-for-high-self-esteem

But first, to be fair, let me list the True statements Suze makes above about indexed annuities:

- “. . . sold by insurance companies” [which I suppose is intended to imply something negative]

- “They do offer a guaranteed return” [the least important feature, actually]

- “[The guaranteed return] can be under the rate of inflation” [yes, we can practically guarantee the fixed account return will be less than inflation. We don’t care, as I’ll explain below.]

- “There are caps” [yes, you’re not going to get principal protection without fees or limits on benefits]

- “[there can be] surrender charge[s]” [The best contracts almost always have surrender charges. That’s how the company protects the risk pool. A properly designed plan and allocation will not incur surrender penalties.]

- The contribution limits were once accurate but not for 2023

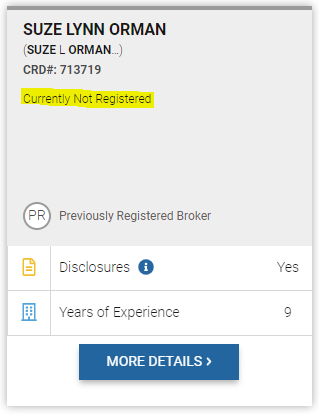

But she never answers the question , “Are they safe?”, instead going off on an ignorant diatribe ending in defamation of my profession. (Which, by the way, she left in 1991 to become an entertainer.)

My key points :

1. In the financial advisory business the key ethic is, “know thy client “.

So, an ethical and intelligent response would have been:

“Yes, they are safe- for multiple reasons -but why are you asking me? You should be asking your adviser to explain how their recommendation fits into your overall plan, how they selected that particular annuity and what all the pros and cons are. I know nothing about you, your goals, your financial situation and have no business telling you anything else. But they are safe because they will protect you from the greatest retirement risks: Longevity risk, inflation risk, sequence risk, and market risk. But I’m neither licensed nor registered to give more than general investment advice [since 1991- see below from https://brokercheck.finra.org/search/genericsearch/grid “]

Do you really feel safe taking advice from a person who isn’t properly licensed, registered and regulated, who knows nothing about you and apparently very little about the latest financial strategies?

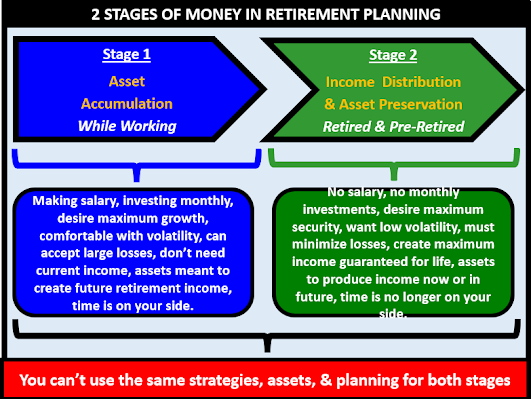

2. Orman seems unaware that there are at least Two Stages to retirement planning. Stage One is the Accumulation Phase, Stage Two is the Distribution phase. She is stuck in Stage One.

Stage One is like a game of checkers with essentially two moves:

- Save as much as you can every month.

- And do it for a long time.

But then in Stage Two it becomes a game of chess; there are many more moving parts, each with their own rules and strategies. What if the questioner follows Suze’s advice, goes all in the market and loses another 15-20% this year? And was planning to retire now? Terrible advice.

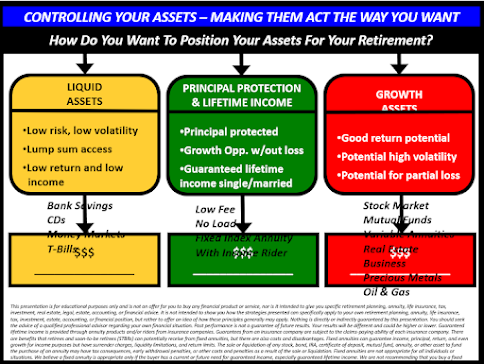

3. She also seems unaware of functional asset allocation (Of course, that would necessitate spending a lot of time learning about the client and designing a plan. Which doesn’t work if your goal is simply mass appeal and self-promotion.).

Most of us advisers refer to these as “buckets:

- The Liquid Asset Bucket – this is essential. Unless you already have an emergency fund of 3-6 months’ budget you have no business investing in the stock market. I see this happening a lot right now (not among my clients): You’ve put money in your 401k, have lost your job and have to raid your now shrunken 401k to meet expenses. And pay extra taxes!

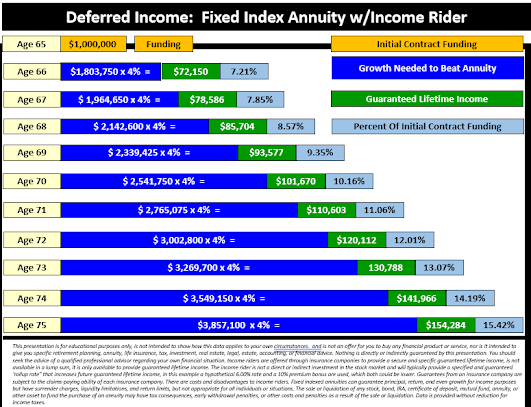

- The Income Bucket– This is the most important bucket, not because I say so but because in study after study retirement satisfaction and security are highest when the retiree has more than sufficient monthly lifetime cash flow. The risk pooling and longevity credits of income annuities (typically supplemental income riders to indexed annuities) are virtually impossible to duplicate elsewhere. I’ve put this challenge out a couple of times in the trade press: Show me how you would guarantee equal or greater lifetime cash flow with $1.0 mil. No responses. So for now ignore everything but the orange and green boxes. A better alternative to this income annuity would have to guarantee more than $154,284 per year in ten years. (Or $101,670 in 5 years of deferral. Choose your year.) What if the market is flat for the next 10 years like it was after 2000 (13 years, actually)? Or lower ? If you withdrew 15.42% you would be out of money in 7 years!

(the specific indexed annuity in this illustration is the IncomeShield10 from American Equity)

- The Growth Bucket– Depending on the client and the state of the markets, indexed annuities can shine here too. Regardless of the investment, the key is some kind of risk management. Orman, of course, knows nothing about the questioner’s current portfolio risk, rate of return needs nor time horizon. Which is why her advice is dangerous.

Insist on evidence and understanding from anyone who gives you financial advice. And really? You’re going to take advice from someone just because they’re famous? Bernie Madoff was famous. Sam Bankman-Fried is famous. Instead, use local, licensed, independent fiduciaries with a lengthy history documented with the proper regulators: https://adviserinfo.sec.gov/individual/summary/2510814

Gary

Your Constructive Comments are Welcome!